The 2020 Atlantic Hurricane season was the most active on record, with a total of 31 tropical cyclones, causing upwards of $60 billion in damages across the Atlantic Basin. Many of the Small Island Developing States in the Caribbean region have small economies which limit the abilities of national disaster prevention frameworks and constrain governments’ financial capacity to respond to disasters caused by natural hazards. The increasing frequency and destructiveness of climate and meteorological events threaten the region’s long-term economic stability and development prospects.

The tourism industry, one of the region’s most important sources of revenue, has been decimated by the COVID-19 pandemic and its associated travel restrictions, border closures, and curfews, depriving households and small businesses of their primary income. The cumulative impacts of the pandemic have left governments with even fewer financial resources to respond to disasters and will likely exacerbate the financial impact caused by natural hazards.

This situation has highlighted the value of innovative regional instruments for disaster risk financing that would allow governments to better coordinate and combine their resources. Having a robust insurance mechanism that limits the worst financial impacts of natural hazards provides governments with greater flexibility and peace of mind when developing a preventative approach to disaster risk management, while promoting regional cooperation and solidarity among participating governments.

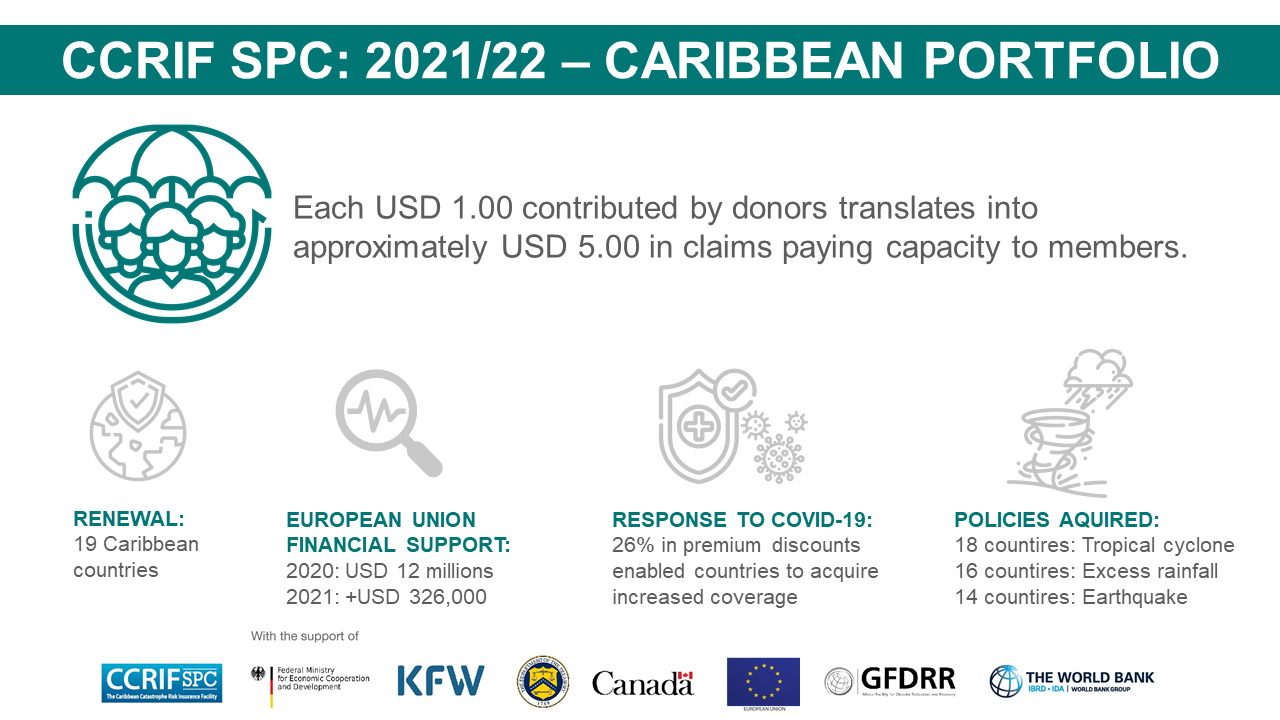

Since its inception in 2007, the Caribbean Catastrophe Risk Insurance Facility Segregated Portfolio Company (CCRIF SPC) has been filling this need by providing insurance coverage solutions to its 23 members, including 19 governments from the Caribbean, 3 governments from Central America and one electric utility company. Members can access policies to cover impacts including tropical cyclones, excess rainfall, and earthquakes. From 2007 to 2020, the CCRIF SPC paid out just over $200 million in insurance claims within 14 days of each disaster event, including a $20 million payment to Haiti in the aftermath of Tropical Cyclone Matthew in 2016. Over time, each U.S. dollar contributed by donors has translated into approximately $5 in claims paying capacity for CCRIF SPC’s member countries.

The European Union has been one of CCRIF SPC’s key supporters since it was formed, having provided financial backing to its initial capitalization as well as to many of CCRIF’s financial services and products. In 2020 alone, the EU provided a grant worth $12 million under its global COVID-19 response to CCRIF SPC to increase members’ insurance coverage and reduce premium costs. This financial assistance was channeled through the EU-funded Caribbean Regional Resilience Building Facility and managed by the Global Facility for Disaster Reduction and Recovery (GFDRR). In 2021, the EU has provided additional financial support of €262,000 ($326,000) through the €3,000,000 Technical Assistance Program for Disaster Risk Financing in Caribbean Overseas Countries and Territories (OCTs) for the delivery of training activities to selected OCTs to better understand CCRIF products and services.

In June 2021, the CCRIF SPC announced that its 23 members renewed their insurance coverage for tropical cyclones and other natural hazards, and for the second year in a row, the total amount of risk insurance exceeds $1 billion. As a result of this renewal, member governments have financial protection during the 2021 Atlantic hurricane season while the region continues to recover from the socio-economic devastation caused by the pandemic.

The CEO of CCRIF SPC, Isaac Anthony, said of the renewals: “CCRIF continues to offer insurance products not readily available in traditional insurance markets. These parametric insurance products allow governments to have access to liquidity within 14 days of an event. This is key as it helps governments reduce budget volatility after a natural disaster, support the most vulnerable in their population and begin the process of recovery in short order.”

The flexibility in the use of the funds made available by the CCRIF SPC has been greatly appreciated by its member governments as they continue to navigate the socioeconomic consequences of the COVID-19 pandemic. Grants provided by development partners, including the European Union and the Government of Canada, have helped governments gain access to vital insurance products and reduce costs in a challenging financial environment. The CCRIF SPC is a working example of an effective disaster risk financing instrument available to governments to assist in post-disaster recovery.

“CCRIF continues to offer insurance products not readily available in traditional insurance markets. These parametric insurance products allow governments to have access to liquidity within 14 days of an event. This is key as it helps governments reduce budget volatility after a natural disaster, support the most vulnerable in their population and begin the process of recovery in short order.”

-Isaac Anthony, CEO of CCRIF SPC

About CCRIF SPC:

CCRIF SPC is a segregated portfolio company, owned, operated, and registered in the Caribbean. It limits the financial impact of catastrophic hurricanes, earthquakes, and excess rainfall events to Caribbean and Central American governments by quickly providing short-term liquidity when a parametric insurance policy is triggered. It is the world’s first regional fund utilising parametric insurance, giving member governments the unique opportunity to purchase earthquake, hurricane, and excess rainfall catastrophe coverage with lowest-possible pricing. CCRIF SPC was developed under the technical leadership of the World Bank and with a grant from the Government of Japan. It was capitalized through contributions to a Multi-Donor Trust Fund (MDTF) by the Government of Canada, the European Union, the World Bank, the governments of the UK and France, the Caribbean Development Bank and the governments of Ireland and Bermuda, as well as through membership fees paid by participating governments. In 2014, a second MDTF was established by the World Bank to support the development of CCRIF SPC’s new products for current and potential members and facilitate the entry of Central American countries and additional Caribbean countries. The MDTF currently channels funds from various donors, including: Canada, through Global Affairs Canada; the United States, through the Department of the Treasury; the European Union, through the European Commission, and Germany, through the Federal Ministry for Economic Cooperation and Development and KfW. Additional financing has been provided by the Caribbean Development Bank, with resources provided by Mexico; the Government of Ireland; and the European Union through its Regional Resilience Building Facility managed by the Global Facility for Disaster Reduction and Recovery (GFDRR) and The World Bank.

For more information about CCRIF SPC: Website: www.ccrif.org | Email: pr@ccrif.org |